John Mosey, CEO of Northstar MLS is known to be one of those leaders that when he finds a business challenge his brokers face, he will do his best to find a solution. He is not afraid to go first. As such he has helped to bring to market many exciting new products that serve the greater good. I had the pleasure of interviewing him about the latest gem he has brought to the market for his subscribers.

John Mosey, CEO of Northstar MLS is known to be one of those leaders that when he finds a business challenge his brokers face, he will do his best to find a solution. He is not afraid to go first. As such he has helped to bring to market many exciting new products that serve the greater good. I had the pleasure of interviewing him about the latest gem he has brought to the market for his subscribers.

It’s a company called TrustFunds. TrustFunds, led by Lynn Leegard, was inspired by challenges she faced when she was General Counsel for Edina Realty, based in Minneapolis, Minnesota. Many of you may know Edina Realty. They are the crown jewel of Home Services of America and they hire only the best and brightest.

This exciting new service has helped automate one of the last elements of transactions that are not handled online – the delivery and deposit of earnest money.

John told me that when he began to talk to his Executive Committee about how earnest money is handled, many became very sheepish. They readily admitted that earnest money is not handled as carefully or safely as it should be. Most transaction documents are processed, signed and distributed from secure online servers. Earnest money, on the other hand, is collected by hand.

Many times, earnest money checks end up in the front seat of an agent’s car or in the bottom of their purses while waiting to be deposited. Earnest money is the last process in the real estate transaction that has not been brought online.

Inefficient and Unsecure Process

Overall the earnest money collection process is inefficient and unsecure at best.

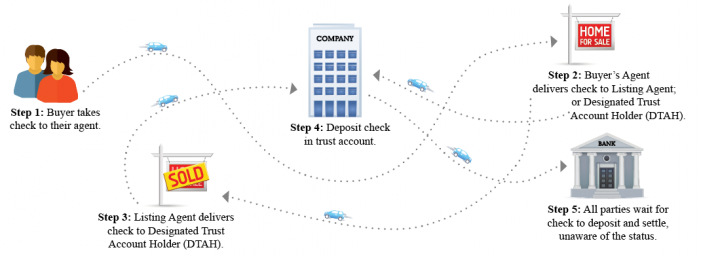

First, the buyer takes the check to their agent, and then the Buyer’s Agent delivers the check to the Listing Agent. Next the Listing Agent takes the check to the Designated Trust Account Holder (DTAH), which could be the listing broker or title company. Fourth, the check gets deposited in a Trust Account.

While all of these steps are going on nobody in the process knows the status of those checks. Everybody in the transaction is waiting for the check to deposit and settle, yet they are all unaware of the status.

Unsecure Process

This process is fraught with a lack of security.

Copies, scans and faxes of the checks can end up in unknown hands. Multiple parties including the agent, office assistant, admin, transaction coordinator and the accounting department have access to the buyers’ personal bank account information. In the age of identity theft, the agent and broker opens themselves up to a ton of risk by not protecting banking information more carefully.

Wire Fraud/Phishing Scams

Many of our brokerage clients have been the victims of wire fraud. Hackers are getting really clever today. They create an email that looks like a legitimate email address from a Gmail account or even a brokerage account email address. They hack into a broker’s email system, and find the emails that discuss wiring instructions for earnest money. Then the hackers send a nefarious email with a fraudulent location for wiring the money. One of our clients lost nearly $250,000 with a phishing scam of this sort.

Regulatory Risk

There is another risk that can be a problem for brokers. If earnest money is mishandled, delivery and deposit deadlines can be missed. Without proof of regulatory compliance a broker can be subject to liability.

The TrustFunds Solution

TrustFunds has completely overhauled this ineffective earnest money process with a whole new approach. The solution offers four key advantages:

TrustFunds has completely overhauled this ineffective earnest money process with a whole new approach. The solution offers four key advantages:

- Convenience

- Real-time status notifications

- Security

- Regulatory compliance

How does it Work?

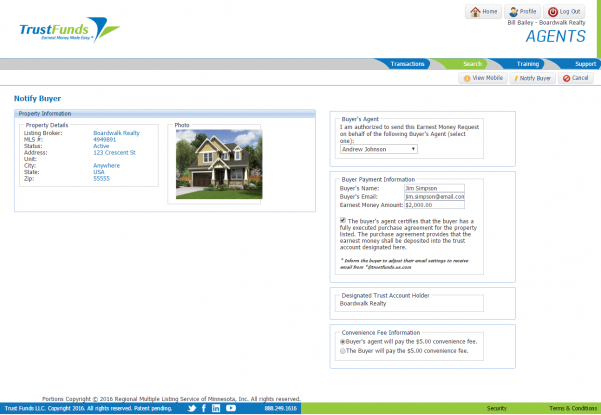

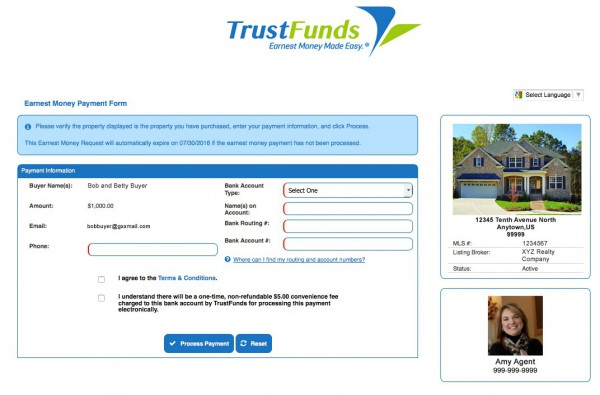

TrustFunds takes the entire manual process and brings it online into a secure environment. It makes it really easy for a buyer to process their earnest money payment online. The agent facilitates the process through a couple of simple clicks initiated on the listing detail page within the MLS. The system provides complete transparency on the progress of the payment as well as the payment history.

The process is really simple with three easy steps:

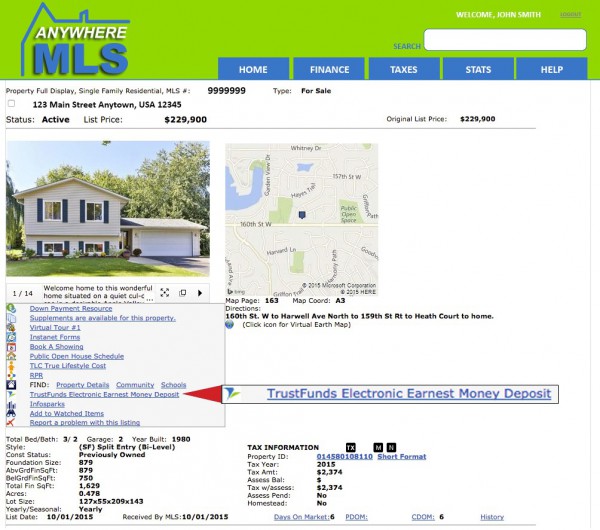

1. One Click from Listing Detail Page

First the agent clicks on the TrustFunds Electronic Earnest Money Deposit link on the listing detail page.

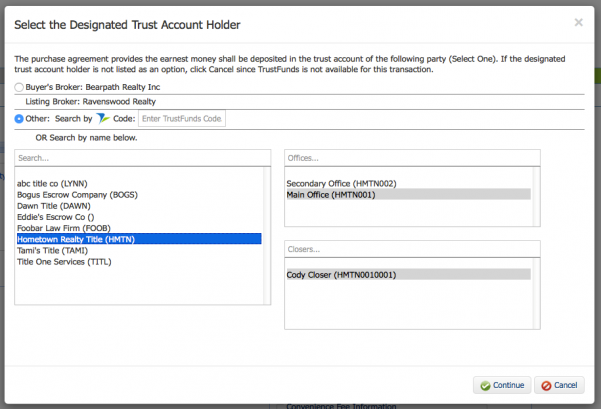

2. Choose Designated Trust Account Holder and Send Request to Buyer

Second, the agent chooses the Designated Trust Account Holder and completes the payment request.

3. Buyer Pays Online

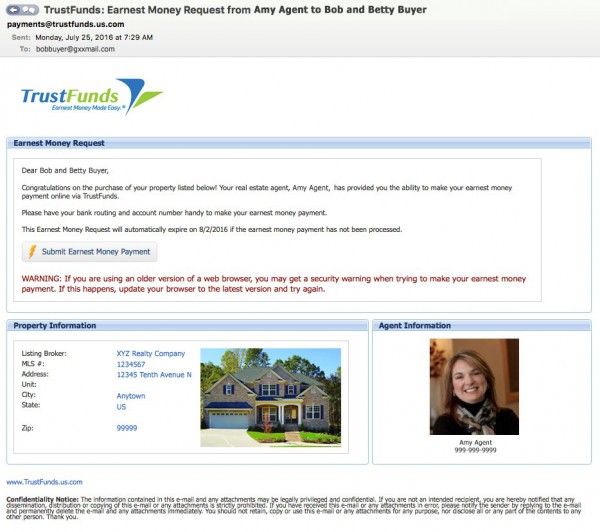

Last, the buyer goes online and pays the earnest money. The email sent identifies an image of the agent AND an image of the property as a failsafe. The email also identifies the name of the agent and the buyer. In addition, it includes the specific amount of the earnest money agreed to in the purchase agreement and other specific property details that would not be known to a typical phishing scam for identification purposes as well.

The buyer then enters their payment information directly. The system again identifies both the property and agent with a photo and detailed information as a double fail safe.

Real Time Status

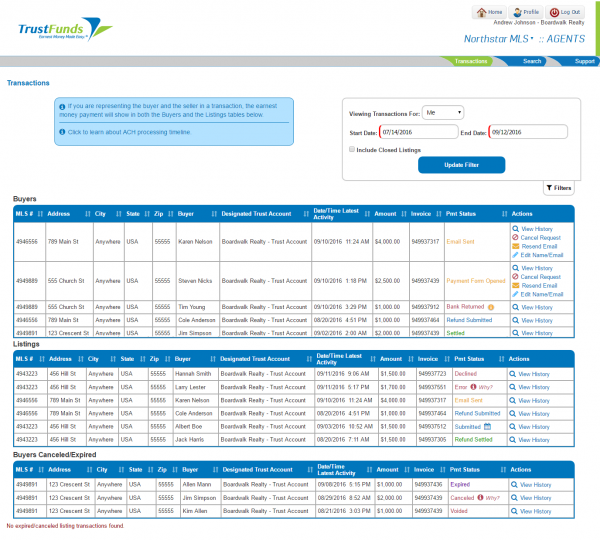

TrustFunds provides real-time access to the status of earnest money for all of the transactions in one easy dashboard.

Payment History

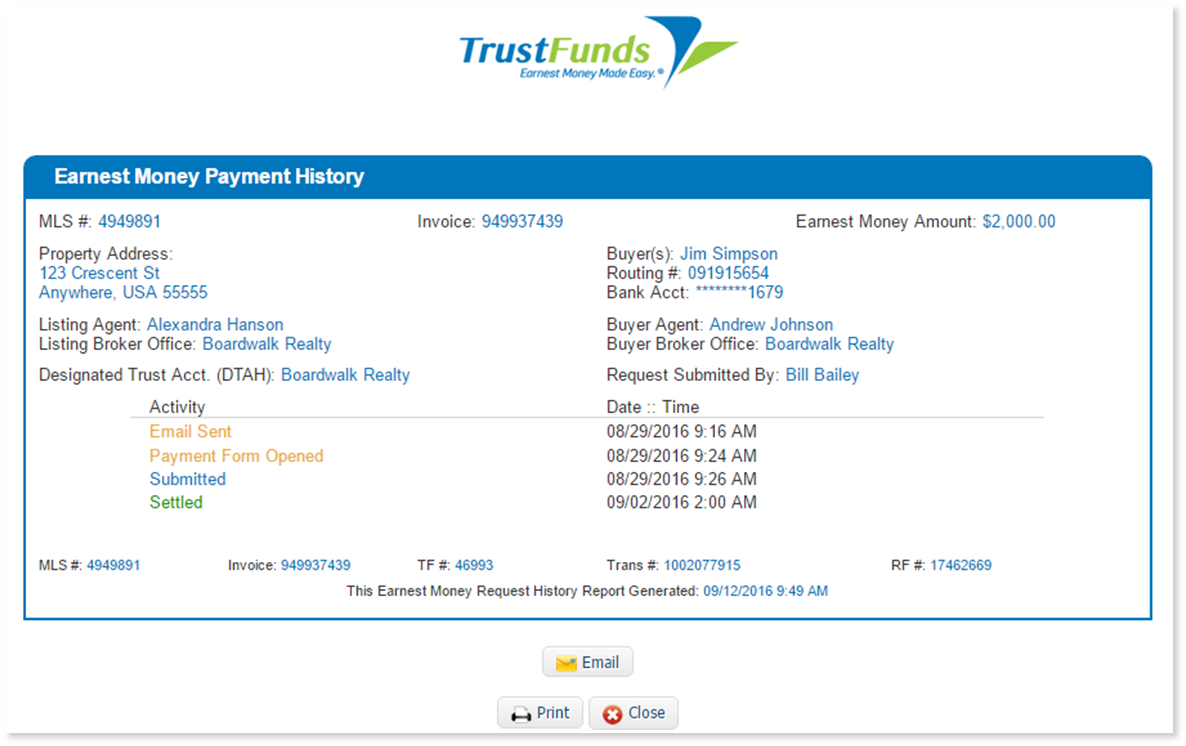

For every transaction there is a complete payment history that is provided putting the broker in complete regulatory compliance. In addition, lenders have loved the convenience of the Payment History Report instead of a photocopy of a cancelled check.

What is the role of the MLS?

Seamless Integration

The program is really easy for MLSs to execute. The TrustFunds system gets installed seamlessly inside of the MLS system making it really easy for the agent to find it and access it.

Easy Adoption

The MLS pays for it as a core service to make it network-wide. Agents do not have to be separately signed up on TrustFunds. If they are a subscriber of NorthStar MLS they can use TrustFunds to collect earnest money from their client and communicate the status of earnest money.

Easy Set-up

Typically in Minnesota the listing broker holds the earnest money. John Mosey, CEO of NorthStar MLS told me that TrustFunds did a lot of the legwork for the MLS working with Minneapolis brokers to get them to add their trust accounts into the system. In other markets, TrustFunds’ system can also do the same with title companies who wish to hold deposits. The system has been designed to adapt to every type of earnest money process.

What do Brokers Think of TrustFunds?

Major Convenience

Coldwell Banker Burnet and Edina Realty, two of the area’s largest brokers signed up for TrustFunds out of the gate. They immediately saw the benefit of the system. They believe it is both a major convenience and risk management tool. Now agents don’t have to drive a check halfway across town. Much like Electronic Signatures, online payment of earnest money has made it a LOT easier to close transactions more quickly.

Does NOT Level the Playing Field

When MLSs look at new services to offer many worry about whether their brokers will believe that the offering will be perceived as “Leveling the Playing Field”. Minneapolis brokers do NOT believe that TrustFunds levels the playing field in any way. They say that it is important service that helps improve the efficiency and security of the real estate market.

Conclusion

It’s rare to find a new technology that solves a fundamental problem in such a simple elegant way. TrustFunds delivers convenience, security and transparency and helps the MLS deliver another really valuable core service to their members. I hope that brokers across America are going to be able to access TrustFunds soon from their local MLS.

For More Information

If you would like to learn more about TrustFunds or schedule a demonstration, you can contact Lynn Leegard, Co-founder and CEO at lynn@trustfunds.us.com or call her at 763.331.4188. She will be attending the CMLS conference next week if you would like to learn more.

Leave A Comment