Rate Lock is not a common term in real estate, but it is pretty easy to understand. And, once you understand it, you will appreciate why trade volume in real estate is going to continue to stay low for a long time, and possibly why the stock market is in for a continued rise.

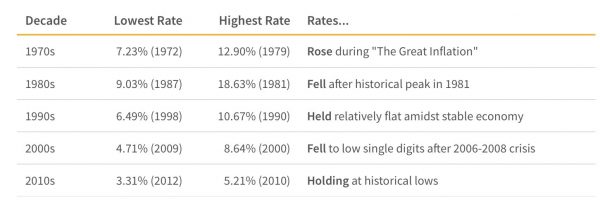

Today’s homeowners are probably in a loan product that is somewhere around 3.31% to 4%. If they decide to sell, they will need a new loan product that will probably be around 5%. That difference of 1% or 2% is what causes the “Rate Lock” effect.

When consumers trade houses, the unpaid balance of their loan will see a significant increase in the interest paid on that loan. That is a pretty significant hit that adds cost to the transaction.

Rate Lock is likely to get worse before it gets better.

You can pick your cycle that you think the economy will be in from today forward. I am inclined to think that our economy is pretty hot right now with very low unemployment and the stock market seems to be bouncing around at the high-water mark. There are many economic indicators that influence the Federal Reserve’s policy on interest rates. The Fed has been bumping them up recently to land softly from the fast-economic recovery.

My guess is 5% to 9% will be the target for mortgage loan rates over the next 5 years. That means that Rate Lock will likely get worse for many Americans before it gets better. Homeowners will stay in their homes longer and use the treasure created from wage increases to fix up their existing home rather than move up to a different home.

Low Unit Volume for the Long Term

If you agree with me about the impact of Rate Lock, then you must anticipate that it will put downward pressure on market velocity. If anything, it will get worse before it gets better. Brokers should continue to operate on the idea that the unit volume in America will not rebound easily. This will have a big impact on high transaction volume brokerages in markets where trade prices are relatively low. Many of the bible and rust belt states are not seeing massive population growth that would demand expanded inventory. Prices will go up, but not rocket up.

I would expect that California and other high price markets will continue to see moderate to high home price growth. Any State that has growth rates that exceed new home development will be challenged to meet the housing demand, and property values will continue to rise.

Stock Market Impacts

Real Estate markets have a significant impact on stock markets. Consumers have low interest rates on their property and that see that their property values are raising. There is little or no incentive to pay down or pay off their mortgage.

As mentioned above, I do think that homeowners are likely to do more home renovations. That is good for the stock market. It creates good paying manufacturing and trade jobs that blusters the middle class. I can tell you that it is nearly impossible to hire a renovation contractor here in California unless you intend to pay insanely high rates. I am not sure how pervasive this trend is across the nation. I tried to Google the trends for home renovations and Google failed.

If homeowners are not able to find home improvement contractors, they will likely invest their money into their retirement fund. The financial markets are already flush with cash. Why else would people put hundreds of millions into starting low margin real estate brokerage companies? There is simply too much cash and it is likely to get worse as more of the non-traditional investors contribute to the market.

A hot public market is going to push high net worth individuals out. Rich investors are going to diversify into private equity rather than invest in companies with $10 Billion public values with little or no profits. They have seen that story play out in their wallets before when bubbles burst. Private equity surges typically cause consolidation and M&A activity. I would expect to see more companies roll up and go public. I guess it is going to be a good cycle for older business owners to cash in their chips.

Should be interesting.

Leave A Comment